30+ percent of income on mortgage

Were not including any expenses in estimating the. X 930 9300.

What Is The Monthly Repayment On A 800000 00 Mortgage With 250000 00 Deposit Quora

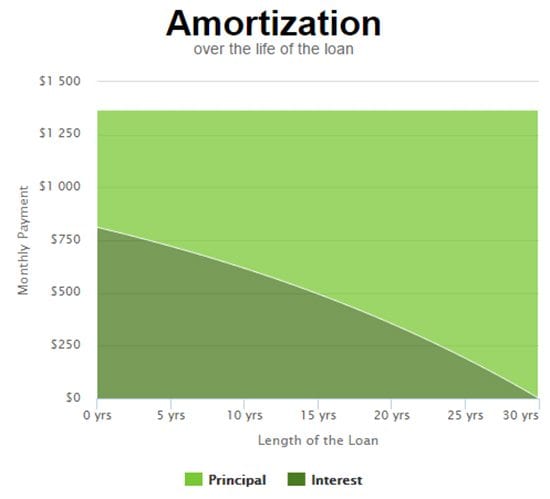

Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest.

. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web The average rate on a 30-year fixed mortgage rose to 511 in the week that ended Thursday according to Freddie Mac up from 311 at the end of last year.

Web A year before the COVID-19 pandemic upended economies across the world the average interest rate for a 30-year fixed-rate mortgage for 2019 was 394. Compare Your Best Mortgage Loans View Rates. Portion of total ordinary dividends.

That may be state taxexempt. Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac 1663 in. Web By default 30-yr fixed-rate loans are displayed in the table below.

Web In this example you shouldnt spend more than 1680 on your monthly mortgage to stick with the percentage of income rule for mortgage. Web 1 day agoThe 30-year fixed-rate mortgage averaged 660 in the week ending March 16 down from 673 the week before according to data from Freddie Mac released. Ad Get the Right Housing Loan for Your Needs.

With that magic number. Web Traditionally the industry says to spend no more than 30 of your gross income on your monthly mortgage payment. Web As a general rule you want to spend no more than 30 percent of your monthly gross income on housing.

Your DTI is one way lenders measure your ability to manage. Get All The Info You Need To Choose a Mortgage Loan. Web According to some experts if you are spending more than 30 of your pre-tax monthly income on mortgage payments then you may be at risk of mortgage stress.

Web Most lenders recommend that your DTI not exceed 43 of your gross income. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web The 3545 Rule.

Typically lenders cap the mortgage. 2 To calculate your maximum monthly debt based on this ratio multiply your. Web 1 day agoHow mortgage rates have changed over time.

If youre a renter that 30 percent includes utilities and if. Ad Compare Best Mortgage Lenders 2023. The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt.

Web Front-end only includes your housing payment. Filters enable you to change the loan amount duration or loan type. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

Web The total of your monthly debt payments divided by your gross monthly income which is shown as a percentage. Ad Calculate Your Payment with 0 Down. Compare Offers Side by Side with LendingTree.

Choose The Loan That Suits You. Web Percentage of eligible income. Apply Online Get Pre-Approved Today.

However as mortgage rates continue to. Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Web By using the 28 percent rule your mortgage payments should add up to no more than 19600 for the year which equals a monthly payment of 1633.

What Percentage Of Income Should Go To A Mortgage Bankrate

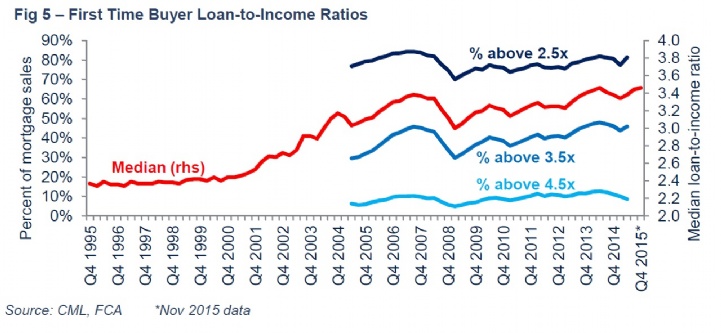

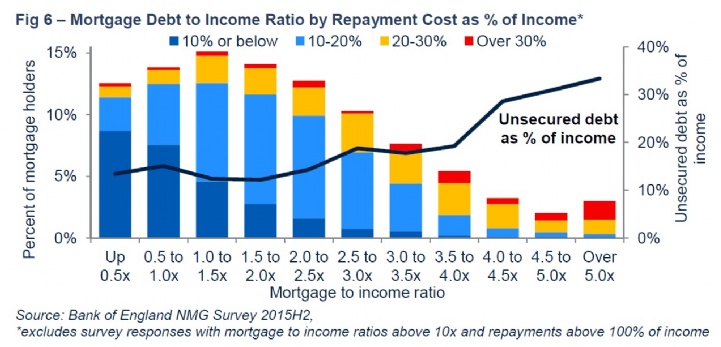

Savills Household Debt

What Percentage Of Income Should Go Toward A Mortgage

Mortgage Calculator Enter Your Income See Your Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Loans 30 Days In Arrears By Loan Originator Download Scientific Diagram

Capital One 30 Day Total Delinquency Rate 2021 Statista

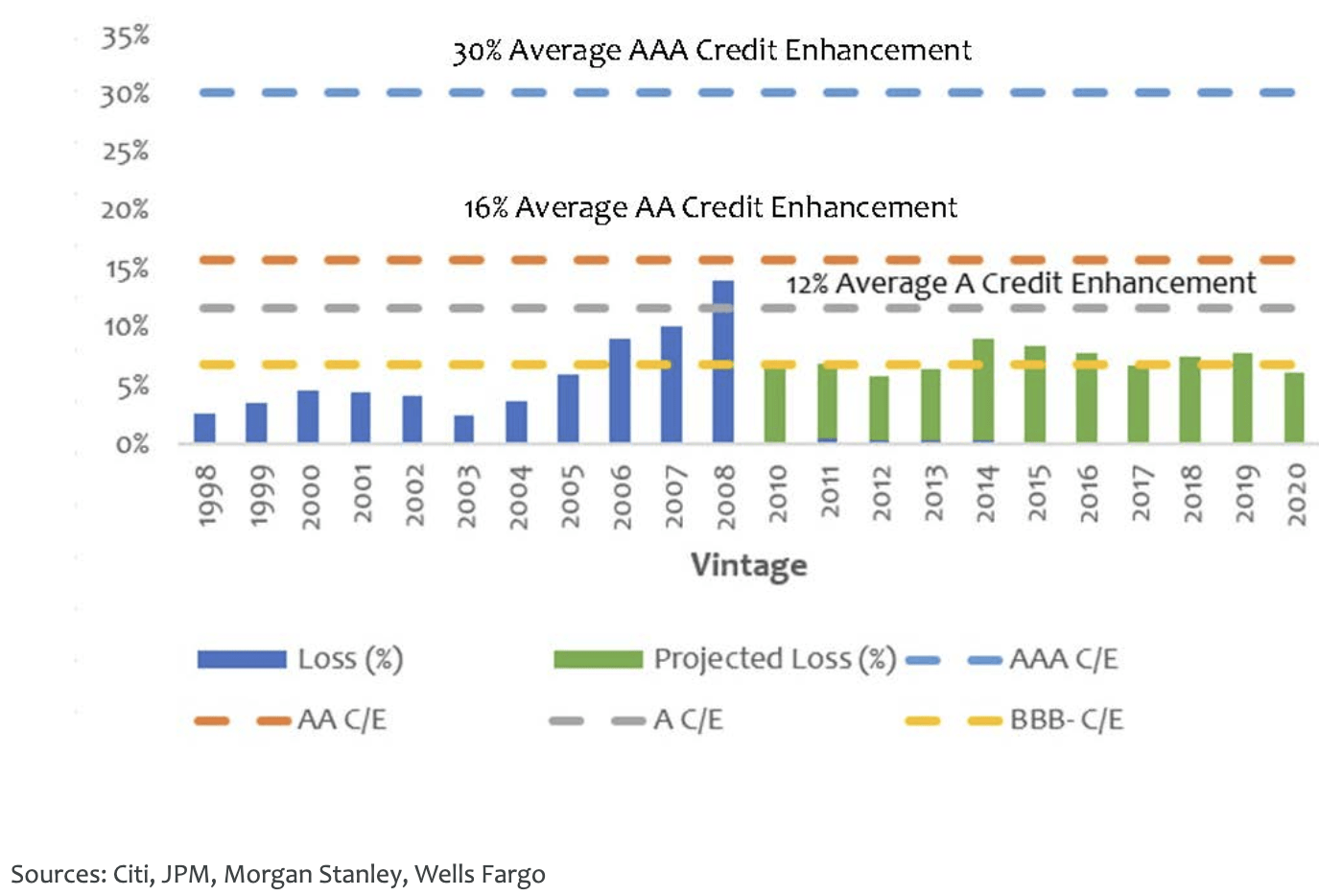

Generate More Income And Maintain Safety With Mortgage Backed Securities Seeking Alpha

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Percentage Of Income For Mortgage Payments Quicken Loans

Savills Guernsey Household Debt

What Percentage Of Your Income Should Go To Your Mortgage Hometap

What Percentage Of Your Income To Spend On A Mortgage

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram

Mortgage Lender Woes Wolf Street

Commercial Mortgage Backed Securities In The Post Covid Economy Global Financial Markets Institute

Home Ownership English Housing Survey Household Report 2008 09

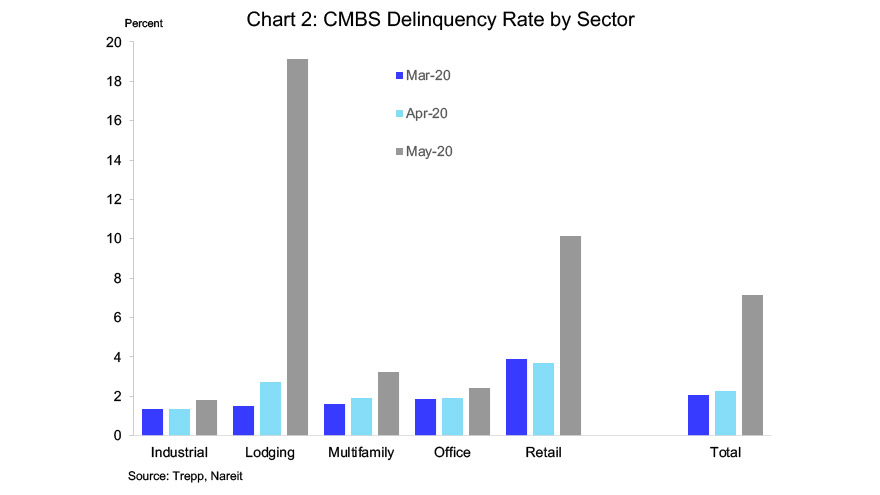

Cmbs Delinquencies Soar In May Nareit